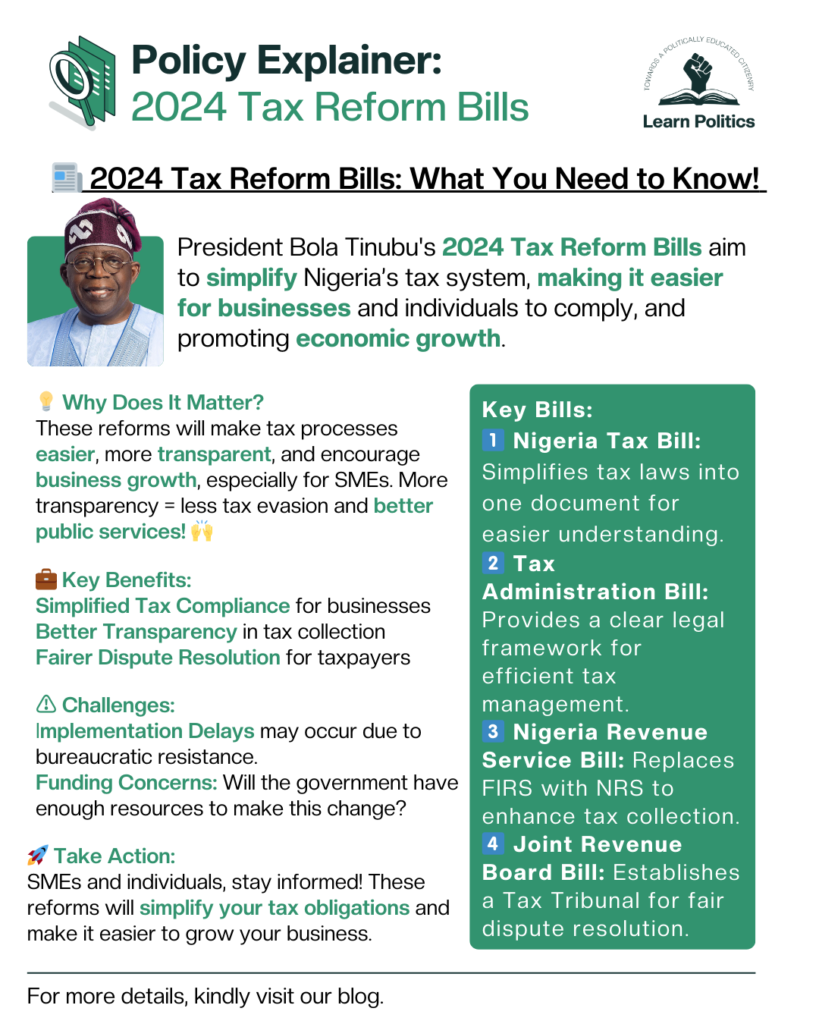

In a bid to overhaul Nigeria’s tax system and improve its economy, President Bola Tinubu recently introduced the 2024 Tax Reform Bills to the National Assembly. These reforms are designed to simplify tax laws, enhance transparency, and boost both business and government efficiency. Here’s a breakdown of what the new tax reforms are all about, why they matter, and how they will affect Nigerians.

Why Does This Policy Exist?

Nigeria’s current tax system has long been criticized for being overly complex, making it difficult for businesses and individuals to understand and comply with tax obligations. This complexity has discouraged investment and hindered economic growth. The 2024 Tax Reform Bills aim to address these issues by creating a streamlined, technology-driven tax process that encourages compliance, reduces disputes, and improves government revenue collection.

What Will the 2024 Tax Reform Bills Do?

The new tax reform bills are made up of four major components, each tackling a specific aspect of tax administration:

1. Nigeria Tax Bill: This bill consolidates various tax laws into one comprehensive document, making it easier for taxpayers to understand and comply with their obligations. This simplification is particularly important for small businesses that often struggle with navigating Nigeria’s complex tax regulations.

2. Tax Administration Bill: Aimed at establishing a clear and efficient legal framework, this bill will reduce the number of disputes between taxpayers and the government. By improving tax enforcement and clarifying the responsibilities of taxpayers, this bill will encourage more people to pay their taxes.

3. Nigeria Revenue Service (NRS) Bill: This bill replaces the Federal Inland Revenue Service (FIRS) with the Nigeria Revenue Service (NRS), modernizing the country’s tax collection agency. The NRS will be responsible for ensuring that taxes are collected efficiently and transparently, using modern technologies to improve accountability.

4. Joint Revenue Board Bill: This bill will establish a Joint Revenue Board, which includes a Tax Appeal Tribunal and a Tax Ombudsman to handle disputes and complaints from taxpayers. This is a major step towards ensuring fairness in tax administration and fostering trust between the government and the people.

How Does It Affect Nigerians?

These reforms will have a significant impact on both businesses and individual taxpayers in Nigeria:

For Businesses: The streamlined tax system will make it easier for businesses, especially small and medium-sized enterprises (SMEs), to comply with tax laws. Less time will be spent on dealing with complicated tax procedures, allowing businesses to focus on growth and innovation

For Individuals: The use of technology will simplify tax filing and payment processes. Individuals will have clearer guidelines on their tax responsibilities, which reduces the likelihood of disputes with tax authorities. The establishment of a Tax Appeal Tribunal also ensures that any disagreements can be resolved fairly.

Key Benefits of the Tax Reform

1. Improved Business Environment: With simplified tax compliance, businesses can focus on expanding and innovating rather than worrying about navigating complex tax regulations. This could lead to a surge in entrepreneurial activity and increased investment in Nigeria.

2. Enhanced Transparency: The introduction of modern technology into the tax system will reduce corruption and improve accountability. Taxpayers will have access to clearer processes, and all tax payments will be traceable, ensuring that government funds are used effectively.

3. Fairness in Tax Administration: The creation of a Tax Appeal Tribunal and a Tax Ombudsman will give taxpayers a formal mechanism to address their grievances. This will build trust between the government and its citizens, as tax administration will be perceived as fair and just.

Challenges and Criticisms

While the 2024 Tax Reform Bills offer significant benefits, there are potential challenges:

Implementation Delays: Given Nigeria’s bureaucratic system, there may be delays in fully implementing the reforms. Resistance to change from certain sectors may slow down the process.

Funding Concerns: Implementing a modern, technology-driven tax system will require substantial financial resources. Some experts are concerned about whether the government can allocate enough funds to roll out these reforms fully.

Regional Concerns: The National Economic Council (NEC) headed by the Vice President on Thursday recommended that the bills be withdrawn from the National Assembly to allow for more consultations from different parts of the country. The recommendation was brought up after concerns were raised by the 19 Northern governors that some provisions in Bills could be detrimental to the North.

However, the President responded to the recommendation made by the NEC saying that there would be no need to withdraw the Bills as the necessary changes could be made during the course of the legislative process.

Call to Action

For businesses and individuals, now is the time to get informed about these upcoming tax reforms. SMEs, in particular, should take advantage of the simplified tax processes to register their businesses and comply with tax laws more easily. Taxpayers can also engage in public consultations and provide feedback on how the reforms can be improved for smoother implementation.

By simplifying tax laws, promoting transparency, and modernizing tax collection, President Bola Tinubu’s 2024 Tax Reform Bills aim to build a stronger, more prosperous Nigeria. These reforms mark a significant step towards fostering trust between taxpayers and the government while improving Nigeria’s overall economic outlook.